Dollar Cost Averaging: The Simple Strategy That Beats Market Timing

I want to talk to you about one of the most powerful yet simple investing concepts that even billionaires swear by: dollar cost averaging. Don't worry if you're not investing in dollars, this principle works with any currency and describes the art of investing consistently over time.

While it's incredibly simple to understand, most people don't follow it. Today I'm going to explain exactly what it is, show you how a multi-billionaire uses this same strategy, and share how I've implemented it into my own investing approach. If you're already dollar cost averaging, I'll give you some advanced tips to take it to the next level.

What Is Dollar Cost Averaging Really?

Dollar cost averaging is essentially the opposite of lump sum investing. Instead of taking all your available money (whether that's €5,000, €10,000, or €20,000) and dumping it into the market when you think it's the "right time," you invest smaller amounts consistently over time, regardless of market conditions.

Think about Bitcoin's recent price action. Looking at where it is today, the question becomes: when do you actually get in? If you're waiting for the perfect moment, you might watch the price climb while telling yourself "now it's too expensive, I'll wait for a dip." Then when that small correction comes, the price shoots up even higher, and you've potentially missed doubling your money.

This is the fundamental problem with trying to time the market: it's incredibly difficult, even for professionals.

Dollar cost averaging removes this pressure entirely. Once you've identified your preferred investment (whether it's ETFs, individual stocks, or cryptocurrency), you simply keep buying regularly and consistently over a long period, no matter what the market is doing.

For busy people like us (juggling jobs, businesses, family obligations), this strategy is perfect. The last thing you want after a long day is to log into your broker, analyze market conditions, and try to guess whether today is the right day to invest.

Lump Sum vs Dollar Cost Averaging: Which Wins?

Honestly, it's difficult to say definitively which strategy performs better long-term. You'll find statistics supporting both sides, depending on who's trying to convince you.

If you could always find the perfect timing for lump sum investing, you'd theoretically outperform dollar cost averaging. But here's the catch: consistently timing the market perfectly means outsmarting the market, which is incredibly difficult. It's similar to picking individual stocks that will outperform the S&P 500 long-term.

Even Billionaires Use Dollar Cost Averaging

Let me share a perfect example: Michael Saylor, also known as "Mr. Bitcoin." His company MicroStrategy now holds over $70 billion worth of Bitcoin. And guess what strategy he uses? Dollar cost averaging.

Looking at the Saylor Tracker (which records all his Bitcoin purchases), you can see he kept buying when Bitcoin was under $20,000 in 2020. As the price climbed, he didn't stop and think "this is getting too expensive." He continued buying on the way up, on the way down, and everywhere in between.

He's not trying to time the market perfectly. He believes in Bitcoin as an asset class and keeps buying consistently. That's the power of dollar cost averaging: even when you have billions at your disposal.

saylortracker.com

The Hidden Advantage: Automation Beats Perfection

Here's where I think dollar cost averaging really shines: you can automate it and forget about it. This automation advantage is huge because it removes human emotion and procrastination from the equation.

I always use the gym analogy. Some people go once a week for three hours (better than nothing, but nowhere near as effective as going four or five times a week for just 30 minutes). The same applies to investing: regular, consistent action beats sporadic large efforts.

With lump sum investing, even if you could time it perfectly (which is unlikely), you still need to remember to actually do it. Life gets busy (work deadlines, family obligations, unexpected events), and suddenly weeks pass without making that investment. This means less time in the market, which works against the power of compound growth.

When you're consistently invested, you capture all those profitable days when the market moves up. Time in the market beats timing the market.

The Power Move: Increasing Your Contributions Over Time

Most people set up their dollar cost averaging and never touch it again. They might start with €50 or €100 per month (which is perfectly fine: we all start somewhere), but they forget the crucial step of increasing those contributions over time.

Let me show you why this matters with real numbers. Using a compound growth calculator, let's say you start with zero and invest €500 monthly in an S&P 500 ETF, expecting a 7% annual return over 30 years:

Without increases: Your portfolio could reach approximately €745,000

Your total investments: €180,000

Growth from compound returns: €565,000

With 5% annual increases: Your portfolio could reach over €1.24 million

A difference of nearly €500,000

Just like you hopefully get salary increases or grow your business profits over time, you should pass some of those lifestyle improvements to your investment allocations. Even if you can't increase every year, try to bump up your contributions every second year. You can run your own numbers using this compound growth calulator.

| Strategy | Monthly Start | Annual Increase | 30-Year Result |

|---|---|---|---|

| Fixed Amount | €500 | 0% | €745,000 |

| Increasing Amount | €500 | 5% | €1,247,000 |

How I Automate My Dollar Cost Averaging Strategy

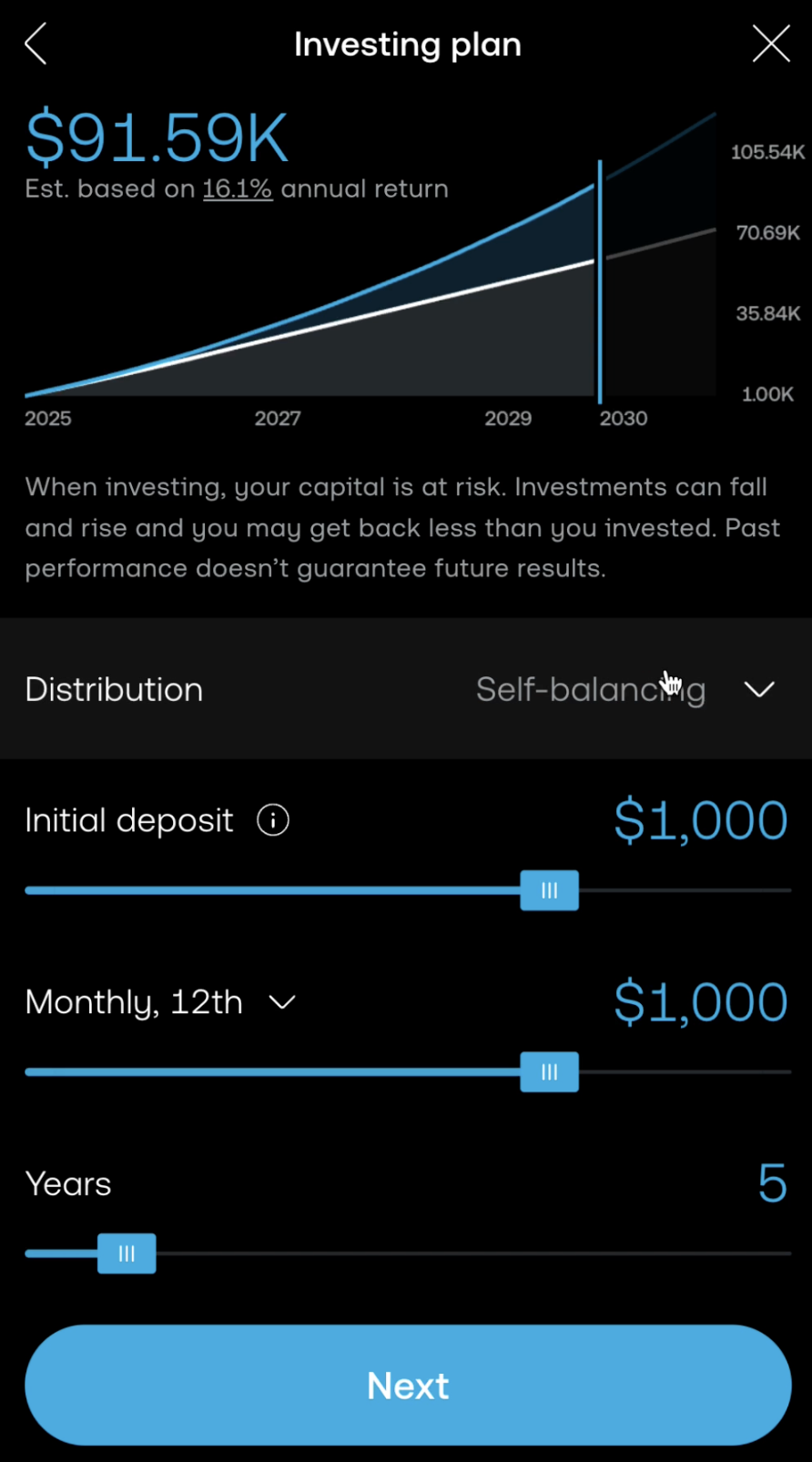

The easiest way to implement this is through automation. I use Trading 212, which allows completely commission-free buying and selling of stocks and ETFs—crucial when you're making frequent purchases.

Here's how I set it up:

Setting Up Investment Pies on Trading 212

Trading 212 calls their automation feature "Pies" (essentially creating your own mini-ETF). You can either follow existing social pies from other users or create your own, which I recommend.

For example, I like investing in S&P 500 ETFs. I can choose from various options:

London Stock Exchange (USD-denominated)

German exchanges (EUR-denominated)

Swiss exchanges

I typically select the distributing S&P 500 ETF in USD from London. The minimum investment is just $1, making it accessible for anyone.

Automation Settings

Once you've selected your investment, here's where the magic happens:

Frequency Options:

Monthly (minimum recommended)

Weekly (my preference for better price averaging)

Even daily if you want

I prefer weekly because I get better average pricing over time. Sometimes I buy slightly higher, sometimes lower, but the average is more favorable than monthly purchases.

Important note: If you're using brokers that charge commissions (like Interactive Brokers or eToro), stick to monthly investments when starting with smaller amounts. Paying €2 commission on a €100 investment is 2% (too high for frequent purchases).

Trading 212 Pie

Complete Automation Setup

Set up recurring bank transfers to your Trading 212 account

Configure your pie to auto-invest weekly/monthly

Choose your investment day (stick to weekdays when markets are open)

Your money automatically flows: Bank → Trading 212 → Investments

I even earn interest on uninvested cash in Trading 212 while waiting for the next purchase date.

New to Trading 212? Claim your free share up to €100 with my promo code KAI.

My Real Dollar Cost Averaging Example

Let me show you this strategy in action. In one of my eToro positions (which now also offers recurring buys), I've been dollar cost averaging into Amazon:

First purchase: $214

Subsequent buys: $209, $197, $209, $225

Current P&L: Some positions up $24, others up $166

Even when Amazon hit $225 (higher than my average), I continued buying because I believe the stock will be worth more in the future. That's the beauty of dollar cost averaging: it removes the guesswork and emotional decision-making.

I do the same with my S&P 500 holdings, consistently adding to my position regardless of short-term price movements.

Advanced Tips for Better Dollar Cost Averaging

1. Use Multiple Brokers Strategically

I use different brokers for different purposes. Check out my guide on why you should use multiple stock brokers to understand how this can optimize your strategy.

2. Consider Weekly vs Monthly

Weekly gives better price averaging but only makes sense with commission-free brokers. Monthly works better with traditional brokers to minimize fees.

3. Reinvest Dividends Automatically

If you're investing in dividend-paying assets, make sure to reinvest those dividends automatically to compound your growth.

4. Track Your Progress

Use tools like my net worth tracker to monitor how your consistent investing is building wealth over time.

Common Dollar Cost Averaging Mistakes to Avoid

Stopping during market downturns: This is when DCA works best (you're buying more shares at lower prices).

Not increasing contributions: Your €50 monthly investment from five years ago should be higher now if your income has grown.

Overthinking the timing: The whole point is to remove timing from the equation. Set it and forget it.

Choosing the wrong investment frequency: Match your frequency to your broker's fee structure.

Why This Strategy Works for Everyone

Dollar cost averaging isn't just for beginners: it's a strategy that works regardless of your investment experience or account size. Here's why:

Removes emotion: No more wondering if today is the right day to invest

Reduces risk: Spreads your purchases across different market conditions

Builds discipline: Creates a systematic approach to wealth building

Fits busy lifestyles: Automation means you can focus on earning more money instead of timing markets

Think of it like going to the gym. Consistency beats intensity. Regular, automated investments beat sporadic large purchases every time.

FAQ Section

Q: What if the market crashes right after I start dollar cost averaging? A: This is actually ideal for DCA. You'll be buying more shares at lower prices, setting yourself up for better returns when the market recovers. Market crashes are DCA's best friend.

Q: How much should I invest monthly when starting out? A: Start with whatever you can afford consistently—even €25 or €50 monthly is better than waiting until you can afford more. The key is consistency and gradually increasing over time.

Q: Should I dollar cost average into individual stocks or ETFs? A: I recommend starting with broad market ETFs like S&P 500 index funds. They provide instant diversification and reduce risk compared to individual stocks. Once you're comfortable, you can add individual positions.

Q: What's the optimal investment frequency—weekly, monthly, or daily? A: Weekly provides good price averaging while keeping things simple. Monthly works if you're paying commissions per trade. Daily might be overkill unless you're using a commission-free platform and have substantial amounts to invest.

Q: Can I dollar cost average with other investments besides stocks? A: Absolutely. You can DCA into cryptocurrency, bonds, commodities, or any regularly tradeable asset. The principle remains the same—consistent purchases over time.

Q: What happens if I need to stop my contributions temporarily? A: Life happens. If you need to pause, that's fine—just restart when you can. Don't let perfect be the enemy of good. Some investing is always better than no investing.

Q: Should I dollar cost average if I receive a large windfall? A: Consider a hybrid approach: invest a portion immediately and dollar cost average the rest over 6-12 months. This gives you some immediate market exposure while still benefiting from DCA's risk reduction.

My Personal Take

I'm definitely team dollar cost averaging. It fits my philosophy of building wealth systematically without constantly monitoring markets or making emotional decisions.

The automation aspect is crucial—it ensures investments happen even during busy periods or market volatility when emotions might otherwise interfere. Combined with gradually increasing contributions over time, this strategy has been fundamental to my wealth-building approach.

Remember, the best investment strategy is the one you'll actually stick to consistently. Dollar cost averaging makes this easier than any other approach I've tried.

Risk Disclaimer: This article is for educational purposes only and should not be considered personal financial advice. All investments carry risk, including potential loss of principal. Cryptocurrency investments are particularly volatile and speculative. Past performance doesn't guarantee future results. Always do your own research and consider consulting with a qualified financial advisor before making investment decisions. The strategies discussed here reflect my personal approach and may not be suitable for everyone's financial situation or risk tolerance.

Automate Your Investing: DCA Strategy with Trading 212

GET MY FREE WEEKLY NEWSLETTER

Crisp, actionable tips on investing & all things money delivered straight to your inbox. No fluff, just the good stuff to fuel your financial growth.